Definition of Budgeting

Hello People,

Are you looking for the best Budgeting today?

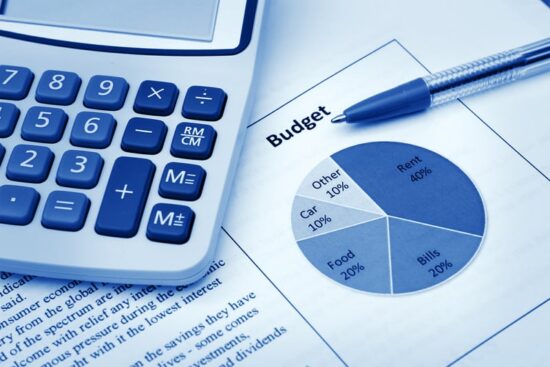

Budgeting’s the handle of making a arrange to spend an organization’s assets, counting cash, time, and faculty. It includes assessing income and costs over a indicated future period, regularly yearly, and serves as a money related diagram for the organization. The budget’s a basic apparatus for money related arranging and investigation (FP&A) since it makes a difference organizations apportion assets proficiently, set budgetary objectives, and screen execution against those goals.

In the setting of FP&A, budgeting isn’t just about numbers; it also involves vital planning, determining, and execution management. It requires collaboration across different offices to ensure the budget aligns with the organization’s overall objectives and operational needs. Budgeting can also include different strategies, such as incremental budgeting, zero-based budgeting, and rolling figures, each with its special focal points and challenges.

Overall, budgeting is a principal perspective of budgetary administration that empowers organizations to anticipate future budgetary conditions, make educated choices, and accomplish long-term sustainability and growth.

When building up your budget, consider executing a budgeting system—like zero-based budgeting or the 50/30/20 framework—to streamline choices.

4 Types of Budgets

There are a few sorts of budgets organizations can utilize, each serving diverse purposes and providing special insights into financial execution. Understanding these sorts is significant for viable financial planning and investigation.

Operating Budget

The Operating budget diagrams the anticipated salary and costs related to the day-to-day operations of the organization. It ordinarily incorporates income projections from deals, fetched of goods sold (COGS), operating costs, and other revenue sources. The working budget is fundamental for overseeing cash flow and ensuring the organization can meet its short-term financial commitments.

Operating budgets are ordinarily arranged on an annual basis, but can also be broken down into quarterly or month-to-month budgets to give more granular control. This sort of budget makes a difference; organizations evaluate their operational productivity and make fundamental alterations throughout the year.

Capital Budget

The capital budget centers on long-term speculations and consumptions, like obtaining modern hardware, updating offices, or launching modern ventures. Not at all like working budgets, which bargain with short-term budgeting, capital budgets are concerned with designating assets for critical capital consumptions that benefit the organization over the long term.

Capital budgeting includes assessing potential speculations utilizing different methods, such as net show value (NPV), internal rate of return (IRR), and payback period analysis. These assessments offer assistance to organizations to prioritize ventures based on anticipated return on investment and alignment with key objectives.

Cash Flow Budget

A cash flow budget is a point-by-point projection of cash inflows and surges over a particular period, ordinarily on a month-to-month basis. It’s pivotal for overseeing liquidity and guaranteeing the organization has sufficient cash to meet commitments as they emerge. It also makes a difference to recognize potential cash shortages and bolsters proactive measures, like securing financing or altering investments.

Cash flow budgets are particularly vital for businesses with regular income designs or those that involve noteworthy fluctuations in cash flow. By closely observing cash flow, organizations can make educated choices about ventures, operational changes, and fetched administration.

Flexible Budget

A flexible budget adjusts for changes in activity levels, letting organizations compare actual execution against budgeted execution at different levels of yield. This sort of budget is especially valuable for organizations with variable costs that fluctuate with generation levels or deal volumes.

Flexible budgets let organizations analyze variances more accurately and understand the effect of movement changes on financial execution. By altering the budget based on real execution, organizations pick up experiences into operational proficiency and make educated choices with respect to asset allocation. Presently that you’ve investigated key budget categories, let’s look at common obstacles to keep in mind.

3 Challenges in Budgeting

Despite its importance, the budgeting process isn’t without challenges. Organizations often face obstacles that can hinder effective budgeting and financial planning.

Data Accuracy

One of the essential challenges in budgeting is ensuring data accuracy. Wrong or deficient information can lead to unlikely budget projections, which can have critical results for monetary execution. Organizations must contribute to vigorous information collection and investigation forms to decrease this hazard.

Moreover, organizations ought to build up clear data governance policies to guarantee everybody understands the significance of data privacy and is held responsible for giving precise data. Customary reviews and surveys of information forms can also offer assistance in recognizing and settling any errors.

Stakeholder Buy-In

Achieving stakeholder buy-in is another common challenge in budget preparation. Different departments might have competing priorities or different points of view on asset allotment, leading to clashes. To overcome this, organizations ought to empower collaboration and open communication through the budgeting prepare.

Engaging stakeholders early and asking for their input can help construct consensus and ensure the budget reflects the organization’s collective objectives. Also, giving preparation and assets to partners can enable them to contribute successfully.

Changing Market Conditions

Quickly changing showcase conditions can make enormous budgeting challenges. Financial variances, shifts in buyer behavior, and mechanical progressions can all affect financial execution and require budget alterations. Organizations must remain watchful and react rapidly to these changes to keep their budgets intact and viable.

Executing rolling estimates or adaptable budgeting approaches can help organizations adjust. By returning to and altering the budget frequently (i.e., budgetary reforecasting), organizations can better confront vulnerabilities and make the most of modern opportunities.

How to Create a Budget: Step by Step

The budgeting process ordinarily includes a few key steps that guarantee a comprehensive and viable budget is made. Each step plays an imperative part in adjusting monetary assets with organizational objectives and destinations.

Step 1: Setting Objectives

The first step is establishing clear financial and operational objectives. These objectives should align with the organization’s broader key objectives and provide a system for decision-making. Setting particular, quantifiable, achievable, pertinent, and time-bound (Shrewd) goals makes a difference, guaranteeing the budget is a significant instrument for directing financial execution.

It’s critical to include key partners in this step, as it cultivates collaboration and guarantees the budget reflects the needs and needs of all offices. This collaborative approach more often than not leads to more grounded buy-in and responsibility for accomplishing the budgeted targets.

Step 2: Gathering Data

Once objectives are set, the following step is gathering pertinent information to illuminate the budgeting process. This information might incorporate authentic financial execution, market patterns, financial figures, and operational measurements. Exact information collection is basic for making reasonable projections.

Organizations frequently utilize different instruments and computer programs to streamline information collection and examination. These devices can computerize the budgeting prepare, cut down mistakes, and progress collaboration among offices. They may moreover conduct showcase investigate or consult industry benchmarks to get their competitive positioning and development opportunities.

Step 3: Drafting the Budget

With goals set and information accumulated, it’s time to draft the budget. This implies assessing incomes and costs based on the collected information and adjusting them to the set-up goals. Distinctive offices might plan their possess budgets, which are then consolidated into one organizational budget.

At this stage, it’s basic to consider components that may affect financial execution, like market conditions, administrative changes, and internal operational efficiencies. Collaboration among divisions guarantees the budget reflects a total view of the organization’s financial scene.

Step 4: Review and Approval

After drafting the budget, it goes through a survey and endorsement process. This ordinarily incorporates displaying it to senior administration or the board of directors for criticism. At this stage, partners might ask for changes or share viewpoints that make strides in the budget’s exactness and relevance.

Clear communication is key amid the survey process, guaranteeing everybody gets the reasons behind budget choices and their suggestions for the organization. Once affirmed, the budget becomes a formal money-related arrangement directing the organization’s activities for the following period.

Step 5: Monitoring and Adjusting

The final step is continuous observing and alteration. Organizations must routinely compare actual execution against budgeted figures to discover fluctuations and assess their financial well-being. This checking permits for educated choices almost asset allotment, operational changes, and vital moves.

Budget alterations might be required when advertising conditions change, unforeseen costs pop up, or organizational needs alter. By remaining adaptable and versatile, organizations can overcome challenges and seize opportunities as they arise.

Best Practices in Budgeting

To make budgeting more compelling, organizations can embrace a few best practices that advance exactness, collaboration, and versatility.

Incorporate Technology

Leveraging innovation can significantly move forward the budgeting process. Organizations ought to consider a budgeting computer program that automates information collection, analysis, and reporting to streamline their approach, decrease mistakes, and boost cross-team collaboration.

Cloud-based budgeting arrangements can also offer real-time access to financial information, letting partners make educated choices rapidly. By grasping innovation all throughout budgeting, organizations can improve effectiveness and fortify in general budget management.

Foster Collaboration

Collaboration among offices is vital for viable budgeting. Organizations ought to advance open communication and collaboration throughout the organization so all partners share a common vision of the organization’s financial objectives. Gatherings and workshops can start collaboration and let partners trade insights.

When individuals feel they’re part of the team, they contribute more contributed in accomplishing the budgeted goals. This shared proprietorship regularly leads to more grounded budgetary execution.

Regularly Review and Adjust

Organizations ought to audit their budgets routinely to gauge execution and discover growth opportunities. Month-to-month or quarterly check-ins offer assistance to help them remain on track and adjust rapidly to new developments.

Additionally, it’s shrewd to welcome partner criticism on the budgeting process. This input can make strides in future budgeting cycles and lead to ceaseless development in budgetary planning and analysis.

2 Quick Tips for Maintaining Your Budget

- Audit your costs week after week to spot any overspending early.

- Set aside a little crisis support so unanticipated costs don’t crash your plans.

Conclusion

Budgeting is a vital portion of monetary planning and analysis that makes a difference for organizations to apportion assets successfully, set budgetary targets, and track execution. By understanding the diverse budget sorts, the budgeting prepare, and the related challenges and best practices, organizations can move forward with their financial management and accomplish long-term success.

As the commerce scene keeps advancing, organizations need to remain adaptable and responsive. By utilizing innovation, advancing collaboration, and conducting standard audits, they’ll explore budgeting complexities and position themselves for persistent development and productivity.

FAQs about Budgeting

1. What is budgeting?

Budgeting is the process of arranging how an organization will distribute its financial assets, including salaries, costs, and speculations, over a particular period.

2. Why is budgeting vital for organizations?

Budgeting makes a difference in an organization’s control of investing, planning future objectives, making progress decisions, and guaranteeing long-term financial stability.

3. What are the fundamental sorts of budgets?

The four fundamental sorts are:

Operating Budget

Capital Budget

Cash Stream Budget

Flexible Budget

4. What is a working budget?

A working budget diagrams anticipated income and costs for day-to-day commerce exercises, making a difference in overseeing cash flow and short-term commitments.

5. What is a capital budget?

A capital budget centers on long-term ventures like gear, offices, and major ventures, guaranteeing reserves are designated to beneficial ventures.

6. How does a cash stream budget help?

It tracks month-to-month cash inflows and surges to guarantee the organization has sufficient liquidity to meet costs and dodge cash shortages.

7. What is an adaptable budget?

An adaptable budget adjusts according to changes in action levels (e.g., generation or deals), making fluctuation analysis more accurate.

8. What challenges do organizations confront in budgeting?

Common challenges include:

Inaccurate data

Lack of partner buy-in

Rapid advertising changes

9. How can an organization progress information precision in budgeting?

By utilizing solid information administration frameworks, conducting customary reviews, and actualizing clear information administration policies.

10. What is the role of partners in budgeting?

Stakeholders guarantee budgets are reasonable and adjusted to the organization’s objectives. Their input advances way better collaboration and decision-making.

Leave a Reply